This form should not be used to accompany a check. How to check Medicare overpayment? What is Medicare overpayment refund form? How are overpayments of benefits administered by DWP? OPR has identified issues where there is only one piece of documentation attached to the first check.

A CGS statistician reviews for acceptability all voluntary refunds based on statistical sampling. In order for the statistician to replicate the sampling and validate the refund amount, with each refund check submission, providers must send CGS the details of the sampling and extrapolation performed to estimate the overpayment. The following forms are designed for DME suppliers who submit claims to CGS.

All forms are in the Portable Document Format (pdf). Benefit overpayment recovery guide 3. This guide has been produced by the Department for Work and Pensions to provide an overview to staff regarding overpayment policy. Its contents may also be shared with external advisors whose clients include those who have either received. Section 75(3) must be read as a whole. Recovery of overpayments.

SOCIAL SECURITY ADMINISTRATION. Please send the completed claim form , your itemized bill, and any supporting … your provider or supplier refused or is unable to file a claim for a Medicare- … medicare credit balance report – CMS. PROVIDER INSTRUCTIONS, FORM CMS.

The Council will endeavour to reach agreement with any employee on the method and timing of recovery. Grant and Loan Overpayments. If you’re still in study or have previously been in study and we’ve contacted you about being paid too much (an overpayment ), you should read this section. It will tell you about grant and loan overpayments including: what. Salary overpayment recovery time limit It’s essential to take the right approach to avoid a dispute with an employee, which could result in legal action.

First of all, make sure you really have overpaid an employee. Payroll may have reported the overpayment , or a staff member, but double check to ensure this is the case. For Cigna for Seniors, please return funds to: Cigna HealthCare of Arizona, Inc. Checks should be made payable to Cigna.

RECOVERY OF OVERPAYMENTS In the event of an overpayment being identified by NWSSP Employment Services (Payroll), the payroll officer will write to the employee as soon as possible after the overpayment has been discovered (refer to Appendix 1). This policy applies to all staff employed by the Organisation and outlines the process of recovery for previous employees, 2. To set the policy for the recovery of salary overpayments ensuring that all officers and staff are treated equally and with consistency where an overpayment has been made to an individual. Even if an overpayment is recoverable, the benefits office can decide not to seek recovery or may accept partial recovery. You can ask the debt recovery centre not to recover or to accept a lower rate of repayment. They are unlikely to agree unless you can show that you did not know that you were being overpaid and that it is very difficult for.

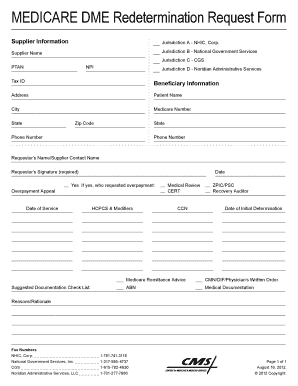

The overpayment redetermination form allows the provider of services to clearly specify the reason(s) he or she disagrees with the overpayment determination (section 6). The form also provides space for a comprehensive and detailed explanation of any additional information that should be considered when the overpayment is reviewed (section 8). PDF download: Supplier Manual – Chapter Overpayments and Refunds – CGS Overpayments and Refunds.

They also notify CGS to initiate the overpayment process. Once CGS is notifie the claim is adjusted and a remittance advice and overpayment demand letter is generated.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.