There are four sections in this form. Download For a third-party authorization of a payoff, there are the requirement of some forms to be filled up and other documentations. You can download this professional statement based on your loan payment schedule. What is borrowers authorization form?

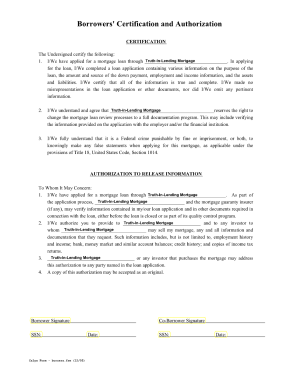

The form may contain three parts: Identifying Information: This part contains information to identify the applicant, the lender, and the subject property. Privacy Act Statement: This is required when the information is retained in a system of record maintained by a Government agency. You are also authorized to release additional information and update the mortgage payoff statement , if necessary. Authorization: Includes the authorization terms and the signature of each borrower.

If this is a line of credit account, please take this authorization as notice to close and freeze my account. This authorization is a continuation authorization for said persons to receive information about my loan , including duplicates of any notices sent to me regarding my loan, an assumption package and payoff statement. You may reproduce this document to acquire reference from more than one source. Federal and State government agencies have prosecuted hundreds of companies and lawyers who illegally charge up-front fees. I authorize the third party listed above to obtain any information on my above referenced mortgage loan account with Shellpoint Mortgage Servicing.

Agents” shall include all real estate brokers and their salespersons or assistants, title or escrow companies and their employees and attorneys and their employees. Utilize the Sign Tool to add and create your electronic signature to certify the Non borrower credit authorization form. Press Done after you fill out the form.

Now it is possible to print, save, or share the document. If you are requesting a payoff statement for yourself (to be sent to you), please complete and sign section 1. Please review your submission. Borrower Information Form.

The following form will be used to obtain information regarding your purchase. This form should be completed BY REFINANCE BORROWERS ONLY. Once the form is completed you will have the ability to save a copy of the form that you submit to The Law Office of Russell C. A payoff statement or a mortgage payoff letter that is prepared by the lender for the borrower mentioning the amount that the borrower has to pay back to close the loan. It also contains the extra details like the rate of interest that the borrower has to pay when he does the repayment.

Use the form on page for each lender. I further authorize the lender to order a consumer credit report and verify other credit information, including past and present mortgage and landlord references. It is understood that a copy of this form will also serve as authorization. The information the lender obtains is only to be used in the processing of my application for a mortgage loan. To protect the privacy of our customers, RoundPoint Mortgage Servicing Corporation (RoundPoint) requires written consent from the borrower to discuss any non-public information regarding existing or prior serviced loans.

A credit card authorization form is a legal document. The cardholder signs it to grant permission to the business to charge their debit or credit card. You can use it for a single transaction or for recurring charges on the card. The signed form helps safeguard your business from chargebacks or any financial problems. Below are links to various frequently requested forms.

Some are PDF documents that are available to download and print. Some are online forms available for online submission or e-signature.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.