Enter one ID and primary customer zip code to retrieve your Case ID. Social Security Number - SSN. Just fill out the form below and a team member from DOR will contact you. The EIN, on the other han is assigned by the IRS. To apply for a TIN, register online as a new business via IN.

Please refer to the Online Business Tax Application (BT-1) Checklist for more information. Below you will find more information about sales tax and additional resources including the business tax application, frequently asked questions, additional tax registrations and sales tax rates. General Information on Sales Tax. Indiana Department of Revenue.

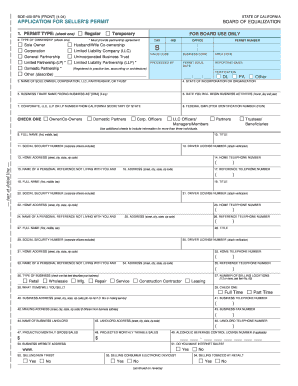

Virtually every type of business must obtain a State Sales Tax Number. If your business sells products on the internet, such as eBay, or through a storefront, and the item is shipped within the same state, sales tax must be collected from the buyer and the sales tax must be paid on the collected tax to the state. Please check the type of consolidated return you are requesting to file. Withholding Tax We’ll need to ask a few questions about your business to get started. Is the business that you are registering a tax preparation service that will file and pay taxes on behalf of business clients?

First and last name. Signature of a Responsible Officer. Taxpayer Identification Number or Federal Identification Number. If the above information is not include your address change will not be processed. A DOR representative will be happy to assist you.

Include extension numbers when applicable. Complete Section B for a Registered Retail Merchants Certifi cate. You also can request your access code be sent to you via the US Postal Service during the INtax registration process.

This legal identification, which is also called an employer identification number (EIN), allows startups to open business bank accounts, apply for loans and other essential tasks. You have to register with the department of revenue in the province you do business. Find out how to pay estimated tax. You are limited to one EIN per responsible party per day.

The “responsible party” is the person who ultimately owns or controls the entity or who exercises ultimate effective control over the entity. Home FAQs Print Contact Us. This process can sound intimidating, but that’s what GovDocFiling is for so that you can quickly get set up online without any extra hassle.

Intax Pay is the gateway for Hoosiers to pay their tax bills and set up payment arrangements. Form GA-110L) directly with the Department of Revenue. Seller must keep this certificate on file to support exempt sales. Pay the full amount of tax owed to the Department of Revenue. Submit $to the Department of Revenue for each business reregistere along with the REG-Form Q. So, it has created the New and Small Business Education Center to help you better understand state tax laws, the tax -filing process, and what services are available to help you as your business evolves.

More information about the collection process can be found on DOR’s website dor. EST to verify any tax bill received.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.