Can the personal representative of deceased per? Can a decedent receive phi? When an individual dies, the personal representative for the deceased is the executor or administrator of the deceased individual ’s estate, or the person who is legally authorized by a court or by state law to act on the behalf of the deceased individual or his or her estate.

A decedent’s personal representative is an executor, administrator, or other person who has authority under applicable State or other law to act on behalf of the decedent or the decedent’s estate. The “ personal representative” is the executor , administrator , or other person with authority under applicable law to act on behalf of the decedent or the decedent’s estate. The legally authorized representative is entitled to information regardless of their prior involvement in the decedent’s care or the decedent’s wishes as to such. Personal representatives should be able to provide documentation supporting their status under an applicable state law.

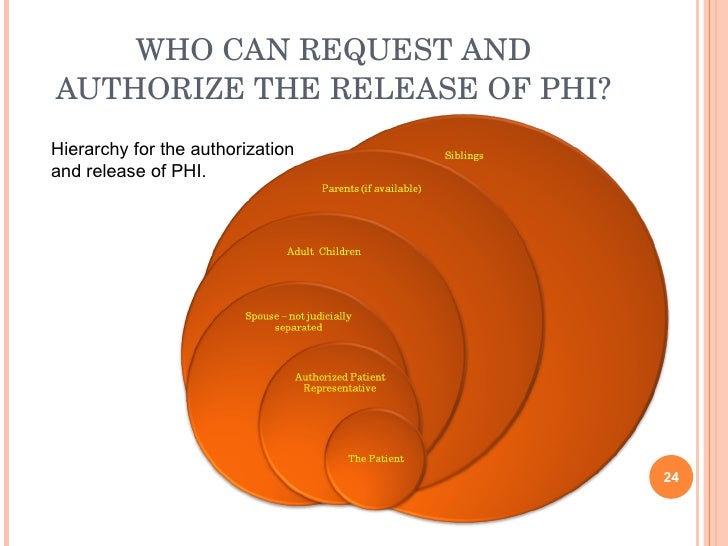

A Personal Representative essentially stands in the shoes of the individual they represent and acts for them, decides for them. The Rule provides two ways for a surviving family member to obtain the protected health information of a deceased relative. A personal representative is a person legally authorized to make health care decisions on an individual’s behalf or to act for a deceased individual or the estate.

In the case of a deceased Individual, state laws also define the persons(s) who can qualify as a “ personal representative ” in the management of matters concerning wills, trusts and estates. Under this rule, for example, an individual’s personal representative might exercise the individual’s right to access the individual’s PHI held by a covered entity in a designated record set. The personal representative stands in the shoes of the individual and has the ability to act for the individual and exercise the individual’s rights. For instance, covered entities must provide the individual’s personal representative with an accounting of disclosures in accordance with CFR 164. A person qualifies as an Individual’s “ Personal Representative ” to the extent the person has authority under applicable state or federal law to act on the Individual’s behalf in connection with the individual’s PHI including a person with authority to act on behalf of a deceased Individual or the Individual’s estate.

In most cases, upon providing Yale with a certificate from a court as evidence of such appointment, the executor or administrator would be treated as a Personal Representative of the patient. As the deceased patient’s Personal Representative , the. Very often the personal representative is the former spouse or other immediate family member of the deceased patient.

However, covered entities need to know that only the person authorized by law may authorize the disclosure of protected health information. Many a covered entity has been caught in the middle of family disputes when a legally appointed personal representative is at odds with. With respect to the PHI relevant to their personal representa. HIPAA HCC) in Standard.

Thus, a personal representative generally has the same rights to access a deceased individual’s PHI as the individual would have had themselves. However, there is some PHI, such as psychotherapy notes, that even. The patient’s right of access has some exceptions, which would also apply to a personal representative.

For example, with respect to mental health information, a psychotherapist. Adults and Emancipated Minors. Authority of Personal Representative. Protected Health Information.

If under applicable law, there is an executor, administrator, or other person having authority to act on behalf of a deceased individual or of the individual’s estate, that individual must be treated as the personal representative of the deceased , with respect to PHI. The court document appointing the individual as an executor or administrator is known as the Letters Testamentary or Letters. Miller “has authority to act on behalf of a deceased individual or of the individual’s estate” an therefore, must be treated as a “ personal representative ” to whom protected. The form was created in response to requests by patients that they have a way to document family members or fri. If the person is deceased , you must have received the legal authority over his or her estate, as defined by state law.

Definition of Personal Representative A patient’s “ Personal Representative ” is the person who has the authority to act on behalf of the patient in making decisions related to health care provided to the patient under California law. It should not be assumed that a.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.