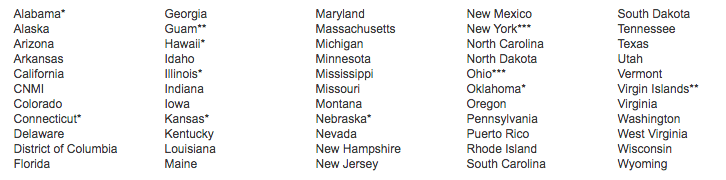

Some states, however, continue to have a two-tier system. Additionally, you need a state’s license or permit to meet the substantially equivalent requirements in other states. In the old days, it was prevalent for the state boards to establish a two-tier system for Certified Public Accountants. The CPA candidates are given a certificate to recognize the completion of the first step in the CPA process, i. Illinois is classified as a two-tier state.

And the license is issued by the IDFPR upon successful completion of their requirements. The state, despite its one-tier status, remains a popular option among Canadians. These states are two-tier. A certificate is initially obtained which does not allow the individual full privileges as a CPA.

After additional requirements are met, the certificate holder may receive a license or permit. Only those CPAs holding an active license or permit are considered substantially equivalent. Candidates in one tier jurisdictions are required to pass both the CPA exam and meet the work experience requirements before earning a certificate and a CPA license. Candidates in two tier jurisdictions will earn a certificate upon passing the Uniform CPA exam. ICPAS is an essential partner in your success, providing you with convenient and customized education, timely and relevant information, influential advocacy, and countless opportunities to make powerful professional connections.

Sis the equation that determines the remediation objective, but Sand Sare needed to determine inputs. After meeting the work experience requirements, you are then eligible to earn the CPA license to practice. Two - tiered states. She is the current Director of Risk Advisory and Forensic Services for Wipfli, LLP�. Work experience is often not required.

No CPA CPE (continuous professional education) hours required. Scope of work is limited as certificate holder cannot own a CPA firm (either as sole owner or partner) or sign an audit report. The final deadline is quickly approaching to become a “Registered CPA ”. The difference is that prior to the amending the Public Accounting Act, there was no regulatory authority over the use of the “ CPA ” title.

Apply to Sit for the CPA Exam and Pay the Exam Fees. However, anyone who. Study for, and PASS the CPA Exam! Pass the AICPA’s Ethics Exam. Fulfill the CPA Work Experience Requirements.

Obtain Your CPA License. For more details, please click. Details on California CPA requirement. The full 1credit hour is required and the approval process takes longer than most other states.

It is one of the few states that. Note: Online Tier Reporting and Editing should be performed only by authorized users. REMINDER: When updating Tier information, you may also have to attach a NEW Site Plan (Map) and electronic Material Safety Data Sheets (MSDSs) or Safety Data Sheets (SDSs).

No comments:

Post a Comment

Note: only a member of this blog may post a comment.