Instructions for Indiana Form POA-Casual conversations with a taxpayer’s representative who does not have a Power of Attorney on file are permitted. Power of Attorney Procedures and Form Power of Attorney allows an individual to act as the authority for another person in specific instances. Indiana Department of Revenue (DOR) requires a Power of Attorney form ( POA-) for customers to authorize another person to have access to their information. You can print other Indiana tax forms here. What is Indiana power of attorney form?

This Power of Attorney can only be revoked by written and signed notice. In Indiana , this form is also known as a POA-1. Renew the POA-in five years if desired. The POA-will remain valid for five years from the date that it is signed. Auditor of the State F. The statutes in Indiana recognize the durable POA as the document used to make big decisions that relate to your medical care and treatment when you are unconscious.

According to the laws of the state, the agent acts as per the directives of the patient to decide on the treatment, care, and whether or not the principal should be hooked to the life-support systems. Indiana Power of Attorney Forms allow individuals to appoint representatives to take care of their finances and health care decisions. Using the durable power of attorney and living will forms (medical power of attorney ), agents can be given the authority to act on behalf of the principal in the event of their incapacitation.

All proceeds and negotiations must be to the benefit of the seller (“Principal”) and must be signed in front of a notary public to be usable. Indiana Limited Power of Attorney Form is a template designed so you may allow someone to use your authority to complete a specific action (s) for a short period of time where you need someone to represent you. As with all POAs, it is important that you know and trust the person being designated as your agent.

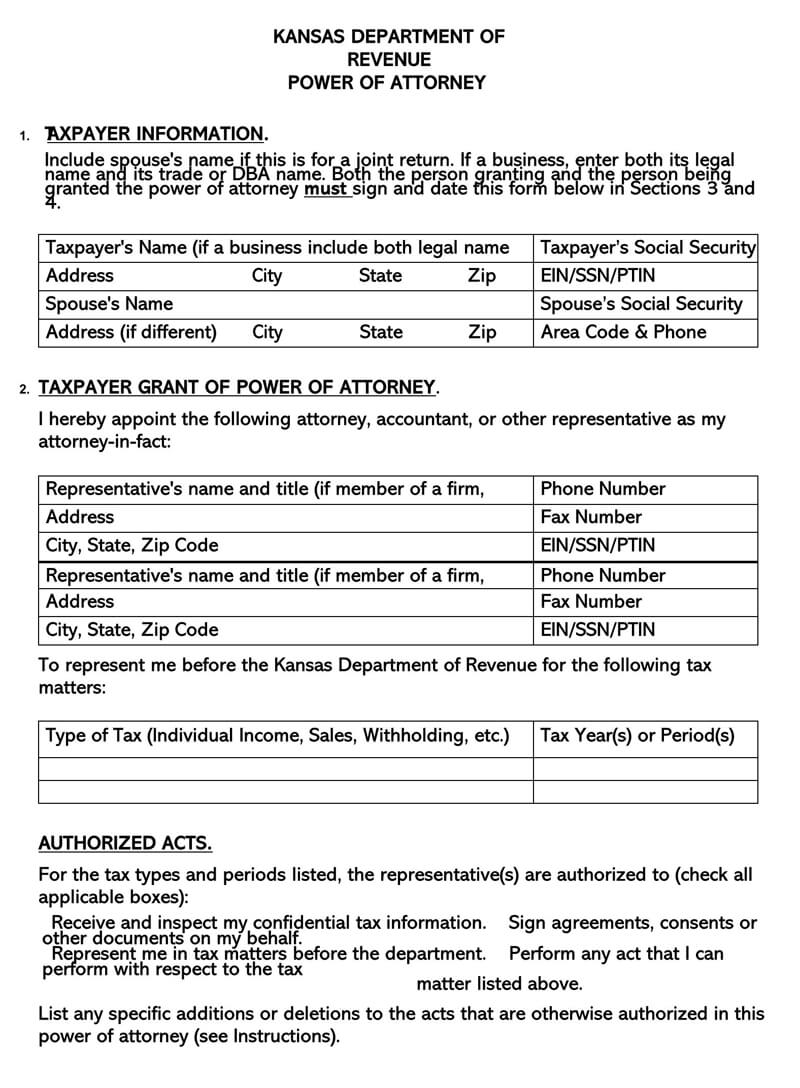

Use Form POA - , Power of Attorney, when you want to give one or more individuals the authority to obligate or bind you, or appear on your behalf. You may only appoint individuals (not a firm) to represent you. Note: Authorizing someone to represent you does not relieve you of your tax obligations. Enter General Information, Tax Matters Information, and Signature Information to complete Form POA - 1. Use the INPOA-screen to enter Representative Information. Indiana tax power of attorney permits a person to hire someone else to file taxes to the Department of Revenue on their behalf.

No, a POA-form must be on file. However, if a married couple filed a joint return, the DOR can speak to either spouse without a POA-form. Quitclaim Deed Form Indiana Elegant Indiana State Forms.

Poa Form Indiana. Indiana Durable Power Of Attorney Form Pdf Fresh Power Attorney Form Indiana Lovely Indiana Durable Power Attorney. Quit Claim Deed Form Indiana.

A power of attorney lets you, as a principal, grant legal permission to someone else, called an agent, to act on your behalf. You might want to execute this type of legal document so you have someone to take care of financial transactions or medical decisions if you become legally incapacitate for example, if you suffer from a coma. This mailbox is used to leave a message to report suspicious activity, information about a recent incident, etc. From there, it is important to distinguish between the two main types of POA : medical and financial.

A medical POA (also known as healthcare POA ) gives a trustworthy friend or family member (the agent) the ability to make decisions about the care the principal receives if they are incapacitated.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.