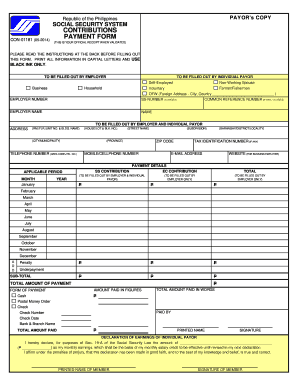

The total contributions paid by the Employer in this payment form includes the Social Security contributions shared by both the employer and employee plus the EC contributions shouldered solely by the employer, in accordance with the SSS monthly contribution schedule. For OFW, the minimum MSC shall be P000. Sickness and Maternity Benefits Payment thru the Bank ForContributions : Contribution Collection List : Contributions Payment Return : Employer Contributions Payment Return : Miscellaneous Payment Return : Contribution Penalty Condonation Form - Installment Proposal : Contribution Penalty Condonation Form - Promissory Note : Member Loans. The advanced tools of the editor will guide you through the editable PDF template.

Enter your official identification and contact details. Can I pay my SSS monthly? How to calculate SSS monthly contribution? SSS Contributions Payment Form Edited - as PDF File (.pdf), Text File (.txt) or read online for free.

For employed members, the present rate of contribution is of the monthly salary credit received by the member or not more than Php1 000. The rate is being shared by the employee () and the employer (). The member’s contribution is of the monthly salary credit not more than P1000.

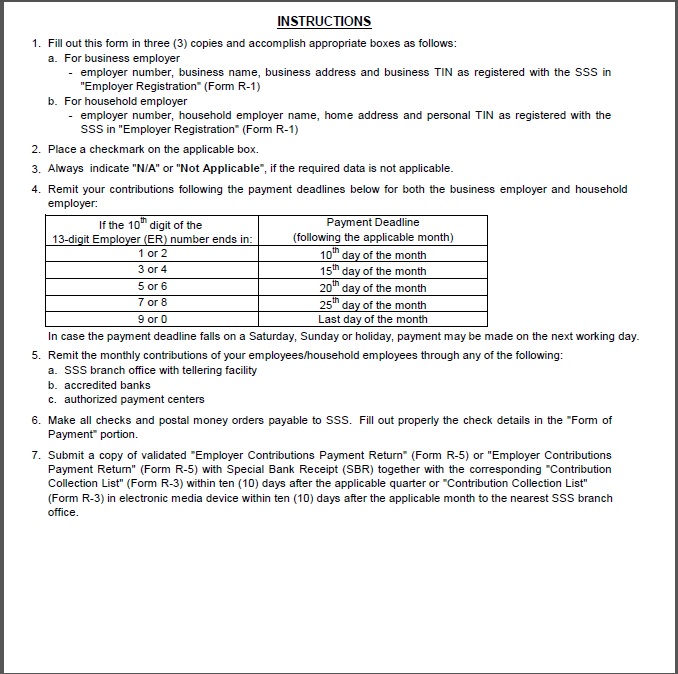

The total premium will be shared by the member () and the employer (). Submit a copy of validated Employer Contributions Payment Return ( Form R-5) or Employer Contributions Payment Return ( Form R-5) with Special Bank Receipt (SBR) together with the corresponding Contribution Collection List ( Form R-3) within ten (10) days after the applicable quarter or Contribution Collection List ( Form R-3) in electronic media device within ten (10) days after the applicable month to the nearest SSS branch office. To all, as of this time of writing you can pay your monthly contribution via Bayad Center PROVIDED you have PRN which you can get online or SSS Branch. Without PRN they will not accept your payment. Actually even if you pay at SSS Branch direcly you have to get PRN first.

Social security system contributions payment form. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds. Available for PC, iOS and Android.

Start a free trial now to save yourself time and money! This way, you’re immediately updated on any revised payment deadline. SSS PRN Payment Reference Number for Members and Employers.

The SSS calls on self-employed and voluntary members to contact the PRN Helpline for their Payment Reference Number (PRN), to implement the Real-time Posting of Contribution Payments (RTPC). If you are planning to continue to pay your SSS ( Social Security System ) contribution , you can now easily do that as they now added more payment centers to cater your SSS transactions. All members, employers and OFWs can now proceed to nearest local collecting partners and merchants before their payment schedule to pay their contribution using the latest online Payment Reference Number or PRN. For this post, the featured SSS forms are for Registration and Membership Forms, Contributions Form , Member Loans Forms, Benefits Application Forms, and forms for Flexi Fund and P. Fund Programs Besides downloading, you can also choose to print any of these government forms whenever there is a readily available printer connected to a computer with active internet connection.

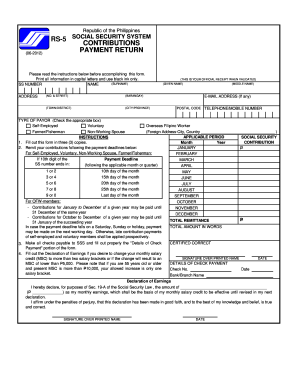

You may also apply for Auto-Debit Arrangement (ADA) for your SSS payments by visiting your bank of account. Pay your SSS contribution by filling out the SS Form RS-or Contributions Payment Return with the required information and put a check mark on the box for Voluntary (Separated) Member. Rs contributions payment return.

SSS Payment is dedicated to private sector taxpayers, self-employed or volunteer members who use the Social Security System. However, taxpayers can access a huge advantage: SSS online payment. An our number called. We asked for an E4- Form (Self-Employed sana ia-apply namin). Sabi ni ate, kung gusto na lang daw ba namin mag-voluntary kasi same lang naman daw yun.

Ate asked for our SSS ID and how much yung contribution namin. As per our last digit sa SSS number namin, pwede pa kami mag-bayad for the month of September. The Social Security System is the Philippines program for private sector workers who work autonomously. The workers have the benefit of accessing their accounts in a completely virtual way. In this way, the SSS Contribution is regulated by the rates defined by the program.

But not below the range of PhP 5and not increased by more than levels of what is listed on the contributions table at a time. Members who use the Social Security System have access to a huge variety of benefits. One of the main is the SSS Online Payment. Currently, all OFW’s can utilize this mechanism and pay their contributions by SSS e-Services! To learn more about contributions , click SSS Contribution and check out!

The SSS RS-form can be downloaded via the SSS website and can also be acquired in the international branches of Philippine banks. International partners of local Bayad Centers can also be used.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.