Fund Retirement Benefit Claim ForSSS P. Any overpayment on a previous loan shall be applied to the subsequent loan , if any. Otherwise, the overpayment shall be refunded upon request of the member-borrower. As you can see government loan requires a full payment if you are resigning on your current company, so what i strongly suggest is to register online and check your monthly loan payment and if you see that you over pay, print it our and go to SSS. Go to Counter under General Information to get your form for over-payment.

What is overpayment on a previous loan? How does the employer report to SSS? Can I get a loan overpayment? Letter of request 0f offset overpayment loan. Plz make a request letter to apply my overpayment past loan to current loan of sss.

Drafts request letter to apply overpayment to current loan ? According to SSS you need to fill out the over payment loan form and submit it to your HR if you are employed and this over payment will be credited as a payment on your existing SSS loan. It is not right for the SSS to keep the money. We’ll also report the delinquency to credit bureaus.

Appeal and waiver rights. If you don’t agree that you’ve been overpai or if you believe the amount is incorrect, you can appeal by filing form SSA-561. You can get the form online, by calling us, or visiting your local. SERVICE FEE A service fee of of the loan amount shall be charged and deducted from the proceeds of the loan.

The employer shall deduct and remit to SSS any outstanding loan balance of new employees. If the SSS discovers that the correct date of birth is later than what has been used in the adjudication of benefit resulting in the over payment of retirement benefit, the SSS shall effect the correction, make necessary adjustment on the benefits, and collect the overpayment. If you recently had an accident while working or you got sick whether because of company job or by nature, this form will help you claim your sickness benefits from medical to paid sick leave as a regular employee.

Making an overpayment on your monthly loan payment, or even making an extra payment toward the loan every now and then can make a big difference in the total amount your loan ends up costing you. Subject: Refund For Overpayment. Loan Overpayment Calculator. Dayes, Thank you for your recent payment of $100.

You might be glad to know that at the time of this payment, your balance was only $29. Our sales bookkeeper has already credited this amount to your account. You will receive the billing statement in your mail by tomorrow. USA and want to use this medium to express my gratitude to Mason Logan for fulfilling their promise and granting my a loan. I was in need of a quick loan I applied from various loan lenders,they asked me to pay some amount of money at different basis but I never got my loan.

You can’t make a repayment to your grant overpayment online. Request For Waiver Of Overpayment Recovery Or Change In Repayment Rate. The issue of a credit card or loan and the amount of credit or lending offered to you depends on an assessment of your personal circumstances. Social Security Number: 2. For credit cards and loans , the interest rate offered to you will also be based on this assessment. It depends on your specific need as a paying, regular, inactive or new social security member in the Philippines.

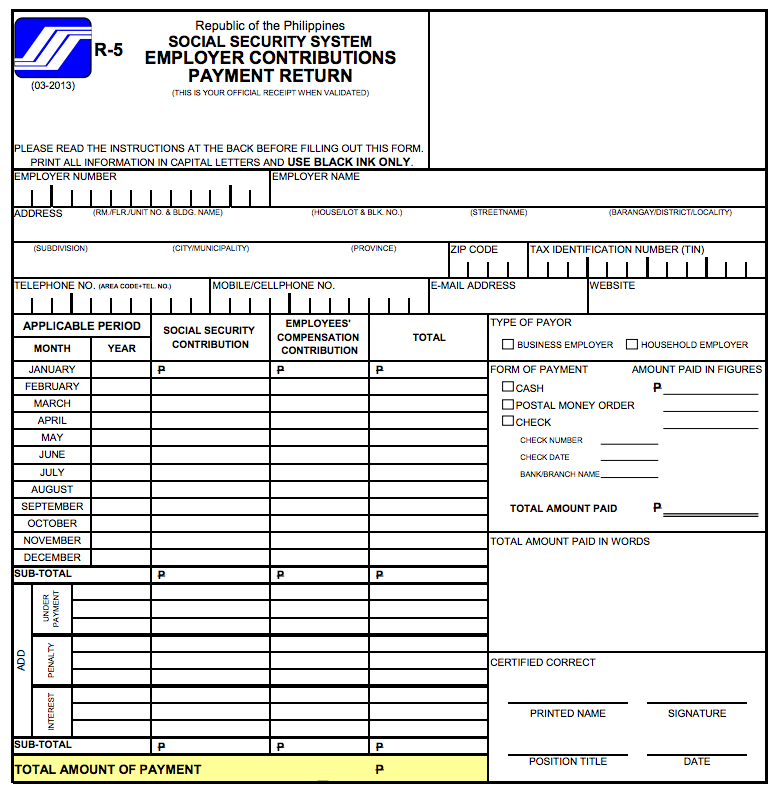

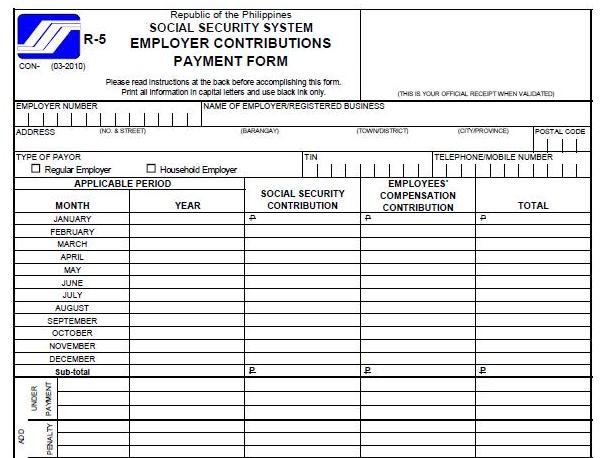

SSS forms come in many types. If you need to download any of the forms whether to avail or apply for a claim, benefit, new account, SSS I disability, sickness, SSS static contribution inquiry, notification, maternity, reimbursement, ECC, paternity benefit claim, contribution. Sign the form (preferably using a pen with a blue ink). Scan or take a picture of the signed ADA form.

Note: Make sure that the form is clear, readable and fully captured. If you make an early settlement we’ll reduce the charge for credit you have agreed to pay us which means you don’t have to pay all the interest.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.