If taxpayers are looking for services, dial 2-1-to find a nearby VITA location and schedule an appointment. Most state level income is from a sales tax of and a flat state income tax of 3. The state also collects an additional income tax for some counties. Receive personally tailored tax advise from exceptional local accounting firms and individual CPAs. We help you connect with in-home and in-office tax accountants near you. You may also find tax counselors and aid by sifting through our tax prep listings.

Unlike the federal income tax system, rates do not vary based on income level. Rates do increase, however, based on geography. However, the income tax rate may be more than in some counties. That means no matter how much you make, you’re taxed at the same rate. Indiana Income Taxes.

Small Business Events in Your Area. Doing Business in the State. The program was available for individuals and businesses with unreported or underreported income tax. Intax Pay is the gateway for Hoosiers to pay their tax bills and set up payment arrangements.

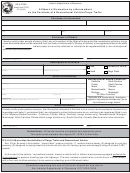

This tool is available to customers who owe individual income taxes , and businesses who conduct retail sales. This makes calculation for out of state sellers much easier. The state derives its constitutional authority to tax from Article of the state constitution.

Tax policy can vary from state to state. A representative can research your tax liability using your Social Security number. Make an Appointment Taxpayer Assistance Centers operate by appointment. When you arrive, wear a mask and stay feet away from others. Sales tax is a tax paid to a governing body (state or local) on the sale of certain goods and services.

In many states, localities are able to impose local sales taxes on top of the state sales tax. DOR launches INTIME to manage business tax obligations. Business owners should get familiar with the needed forms and registrations, as well as the list of exempt items. Since the taxes are in arrears, you owe the total annual taxes due for the previous year, but rather than pay it in one lump sum, you have the option to pay percent in May and the remaining percent in November. Take Possession of the Property Arrange for a sheriff to accompany you, if neede when you take possession of the property.

A property is eligible to be sold at a tax sale when the prior year’s spring installment of property taxes remains unpaid. Include your account number, tax type, start date and end date for the periods needed. We will generate and mail the form (s) to you.

Enter the Case ID and one other ID for verification. Select a customer type. It’s a flat tax rate of 3. But on top of state income taxes, each county charges its own income tax. A majority of states tax some type of business income derived from company business in the state.

While groceries are exempt from sales tax , prepared foods are taxable. In addition, some grocery items are taxable. These items fall into three categories, candy, soft drinks, and dietary supplements.

This interactive tool will help you find out the status of your refund.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.